UC Berkeley, of course, is one of the top engineering schools in the nation, an institution that needn’t take a backseat to any peer—including a certain private university nestled in the San Francisco Peninsula. But there’s one area where Cal’s engineers and entrepreneurs have admittedly played catch-up to private, heavily endowed universities: ramping up for global markets.

Until last year when the Haas School of Business, the College of Engineering, and the Office of the Vice Chancellor of Research collaborated on the formation of SkyDeck.

SkyDeck, it must be emphasized, is not an “incubator” it is an “accelerator.” An incubator is one step up from a skunk works, a place where ideas are hatched into nascent products. Accelerators take such products and supercharge them.

“Lots of universities have in-house incubators,” said Zen Trenholm, a spokesperson for SkyDeck whom we interviewed by phone. “Those are places where ideas are evaluated, and small bets may be made on the teams [of product developers]. Maybe grants are arranged, or small investments are made in exchange for some equity.”

Accelerators, by contrast, only deal with “devices and services that are already in the marketplace, that are proven, that have some traction. We help them take their next steps toward expansion.”

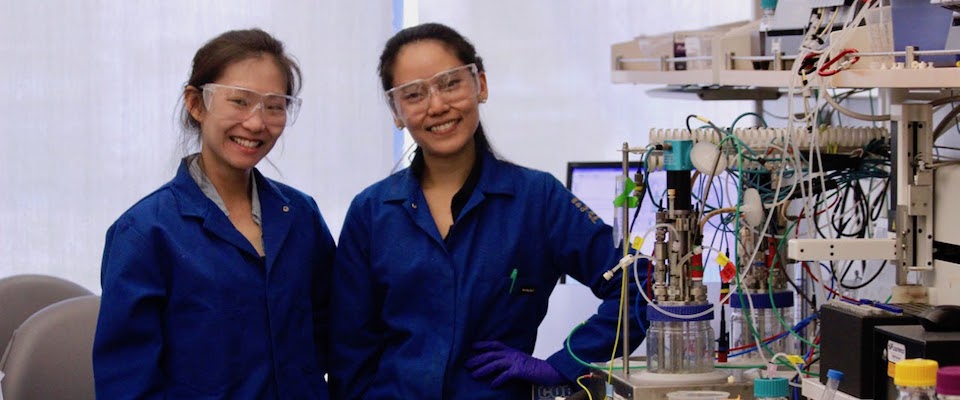

Located in a penthouse suite of the Chase Building on Shattuck Ave. above the Downtown Berkeley BART station, SkyDeck matches entrepreneurial teams with “designated mentors.” The mentors help the teams negotiate the various morasses—fiscal, legal, and organizational—that can bemire budding companies. The process is augmented by a wide range of experts who drop into the SkyDeck suites to lecture or simply hobnob. The teams are also encouraged to engage with one another, in the belief that intellectual cross-pollination will enhance the chance of success for all.

SkyDeck currently nurtures more than 20 teams, with products ranging from mobile shopping apps to energy management systems for small commercial buildings. The teams typically rotate through on a six-month basis, said Trenholm, “though some stay longer if they make a good case for it.”

How do you become a SkyDecker?

“Well, it’s a rigorous process,” acknowledges Trenholm. “First, you have to have a UC association—you have to be a faculty member, graduate or undergraduate student, or an alumnus from the past five years. The application requires detailed responses, and is heavily reviewed [by SkyDeck principals]. Then you have to come in and make the pitch, and you have to be good. The thinking here is that if you can’t pitch, you can’t compete in the marketplace.”

Chris Anderson, one of the founders of Hooktheory, a firm that produces software for musical theory and songwriting instruction, confirms getting into SkyDeck was tough.

“But it was worth it,” he says. “They take no money or equity, and they provide you with offices, conference facilities, mentors, and introductions. And they help you hone in on your particular issues. For example, they don’t just tell you how to raise venture capital. They help you determine if you even need venture capital, and if you do, when you should take it, and how much.

But most important, says Anderson, “you’re in this environment surrounded by other entrepreneurs, and you learn a tremendous amount from their insights and experiences. Plus, the SkyDeck offices are open 24 hours a day, so you can drop in whenever you have the time. Three of us founded Hooktheory, and all three of us work full time at Lawrence Berkeley Lab. So we show up at SkyDeck three nights a week, and work from 7 to midnight. For us, having that kind of flexibility is invaluable.”

Does Anderson think SkyDeck will launch him into the realm of fabulous wealth and luxury? No. And—perhaps reflecting the virtues exemplified by public education—he’s fine with that.

“Sure, everyone dreams of being a billionaire,” he says. “But songwriting is a small niche. Our products are selling well, and we think we’re on the way to making this a solid, sustainable business and a good secondary source of income for the partners. We’d consider that a great success.”

—Glen Martin