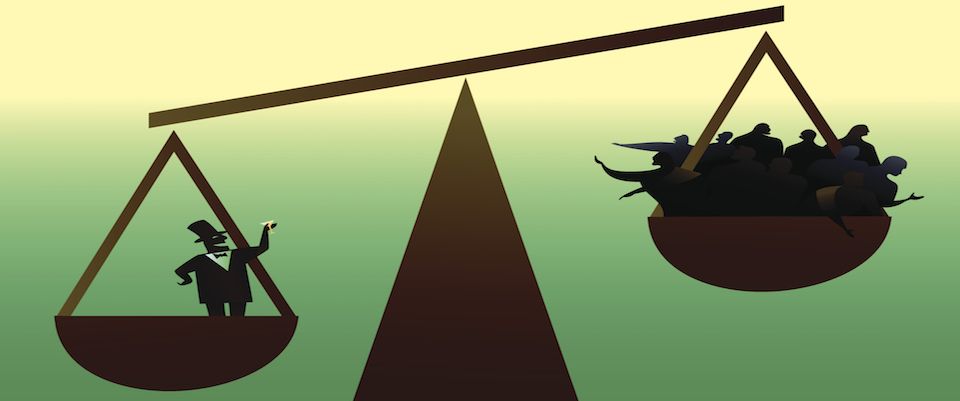

A veritable wonk storm is erupting over the share-the-wealth plans of Democratic presidential candidate Bernie Sanders, with the country’s leading Democratic economists joining the hail of public letters, op-eds and blog posts debating whether his numbers add up or are merely magical thinking.

“When Republicans have proposed large tax cuts for the wealthy and asserted that those tax cuts would pay for themselves, we have shown that the economic facts do not support these fantastical claims….We have applied the same rigor to proposals by Democrats, and worked to ensure that forecasts of the effects of proposed economic policies, from investment in infrastructure, to education and training, to health care reforms, are grounded in economic evidence….Friedman asserts that your plan will have huge beneficial impacts on growth rates, income and employment that exceed even the most grandiose predictions by Republicans about the impact of their tax cut proposals. As much as we wish it were so, no credible economic research supports economic impacts of these magnitudes. Making such promises runs against our party’s best traditions of evidence-based policy making and undermines our reputation as the party of responsible arithmetic. These claims undermine the credibility of the progressive economic agenda and make it that much more difficult to challenge the unrealistic claims made by Republican candidates.”

The retort to Friedman’s analysis was echoed by others, including economist/New York Times columnist Paul Krugman. But it also triggered other retorts in return, such as this one from James K. Galbraith, former executive director of the Joint Economic Committee now at the University of Texas at Austin:

“It is not fair or honest to claim that Professor Friedman’s methods are extreme. On the contrary, with respect to forecasting method, they are largely mainstream. Nor is it fair or honest to imply that you have given Professor Friedman’s paper a rigorous review. You have not. What you have done, is to light a fire under Paul Krugman, who is now using his high perch to airily dismiss the Friedman paper as “nonsense.” Paul is an immensely powerful figure, and many people rely on him for careful assessments. It seems clear that he has made no such assessment in this case. Instead, Paul relies on you to impugn an economist with far less reach, whose work is far more careful, in point of fact, than your casual dismissal of it. He and you also imply that Professor Friedman did his work for an unprofessional motive. But let me point out, in case you missed it, that Professor Friedman is a political supporter of Secretary Clinton. His motives are, on the face of it, not political. For the record, in case you’re curious, I’m not tied to Professor Friedman in any way. But the powerful—such as Paul and yourselves—should be careful where you step.”

As of Saturday morning, it was a free-for-all: the Dollars and Sense blog was linking to 17 (and counting) separate letters, columns and articles dissecting Sanders’s economics—what some were calling a “unicorn hunt.” Some delved into the details of the analysis; others debated whether the fact that Friedman turned out to be a Clinton supporter was an awkward embarrassment, or proof of the objectivity of his analysis defending the Sanders plan.

Even Sanders’s supporters acknowledge that his single-payer health care plan would cost $15 trillion over 10 years, meaning that every adult and child would have to cough up about $50,000 if assessed directly. But that’s not how it would play out, of course: The feds aren’t going to send black helicopters full of IRS agents to orphanages to dun the residents. They’d find other ways to raise the money. And Cal’s Robert Reich, for one, thinks arguments against Sanders’ single-payer scheme are “duplicitous,” noting such a plan wouldn’t have to accommodate “…the huge (payouts) on advertising, marketing, executive pay, and billing” associated with our current system, which is based on for-profit insurers.

Further, Reich, professor at the Goldman School of Public Policy, is four-square behind Sanders’s idea of taxing Wall Street trades to help students defray spiraling college costs.

“The real problem is too many young people still can’t afford a college education,” Reich recently blogged. “The move toward free education that began in the 1950s with the G.I. Bill and extended into the 1960s came to an abrupt end in the 1980s. We must restart it.”

Friedman concurs with Reich that the kerfuffle over Sanders’s game plan is more hot air and reflexive Republican ire than substance. In his response to a Wall Street Journal article excoriating Sanders’ proposals, Friedman acknowledged that the candidate’s single-payer health care proposal would require a federal outlay of $15 trillion over a decade, “…but the (Journal piece) neglects to add that by spending these vast sums, we would, as a country, save nearly $5 trillion over ten years in reduced administrative waste, lower pharmaceutical and device prices, and by lowering the rate of medical inflation…”

Moreover, writes Friedman, a single-payer plan would save businesses and state and local governments money because they would no longer be on the hook for employee health insurance; regular folks would benefit because health care coverage and access would expand dramatically.

Stay tuned. Or, as the writer of the Dollars and Sense list of links concludes: “This is all I have for now. I am sure there will be more.”